The FOMC’s policy announcement today came out essentially as expected without any surprises in the prepared remarks. Equities initially rallied, but the press conference was a bit rockier and caused a pullback in stocks and bonds that lasted through the close. In the Q&A session that followed, Fed Chair Powell left the door open to a 50bp rate hike in March, and he repeatedly harped on how the Fed may need to get more aggressive to fight inflation. This caused the market to begin to price in a 5th rate hike for 2022 (we’re currently at about 4.75 based on Fed funds futures), and equities are taking this as a “you’re on your own” signal for now; however, it’s important to remember that the Fed is going to remain data dependent. If inflation comes down over time—and we believe it will—this could set the stage for a positive surprise.

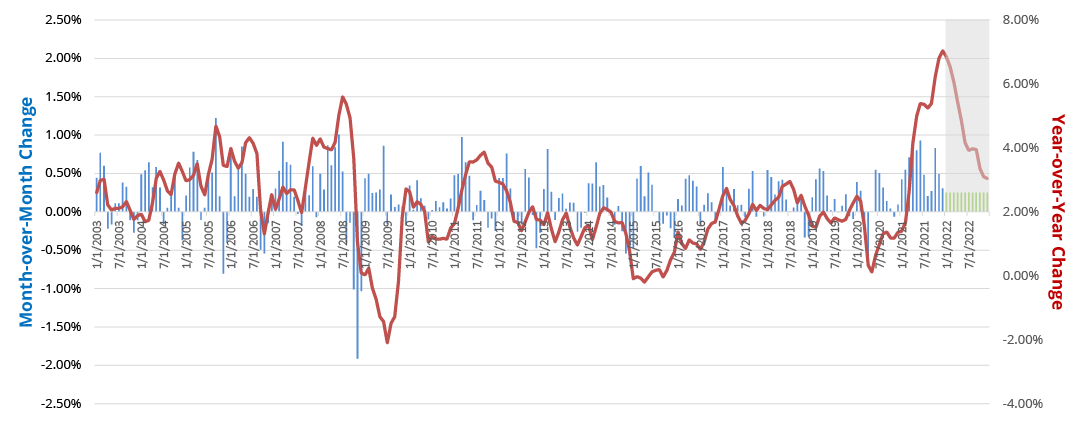

Below is a chart of the year-over-year change in CPI (red line) overlaid on a bar chart of the monthly component of the CPI (grey shaded area is projected). The first half of 2021 saw relatively strong inflation month after month as we dealt with the initial phase of the economic reopening process. Supply chains were just starting to come back online, and getting goods and materials was a logistical nightmare. Then the rate of growth decelerated until the holiday shopping season began to heat up. Consumers were told to get out and shop early, and this strained supply chains further, contributing to the spike that you see in October. This spike then decelerated through year end. Remember, we’re not looking for the CPI to necessarily decline—we’re just looking for a deceleration back to a more historically normal level of growth.

Figure 1 – U.S. Consumer Price Index % Change NSA

Source: Bloomberg, Bureau of Labor Statistics, Alpha Cubed Investments

If we project the CPI growth forward at a 0.25% monthly pace, the end-of-year headline number for 2022 would be 3.04%. This is a reasonable pace on average for sequential growth, but the trajectory likely won’t be this consistent. As we’ve been saying, this recovery is going to happen in fits and starts, and we’ll see that here too, including some new periods of acceleration but likely in more fleeting bursts.

CPI data for January will be announced on February 10, 2022.