(Updated on March 29, 2022)

In the face of the Federal Reserve beginning to unwind its pandemic-era emergency operations, we want to refocus on a topic that we have emphasized in our recent investment letters: valuation. Over the past couple of years, the easy-money policies of the Fed and immense amount of both monetary and fiscal stimulus that has been injected into the economy—as well as the growth of firms like Robinhood—have led to a decoupling of many stocks from the fundamentals of the underlying businesses that they represent and, in some cases, an outright gamification of stock trading. Momentum has been the name of the game, and we have witnessed dollar after dollar chase gains in these high-flying and “meme” stocks that mostly speculators and retail investors have grown attached to. With the relaxation of support for markets from the Fed and the dwindling of fiscal stimulus, however, we believe that this period may be nearing an end, and a return to a more historically normal level of valuations and market environment could be ahead. The point that we want to emphasize in this update is that the ultimate success of a company’s business is only one factor in the success of an investment in that company’s stock. Valuations matter, and a normalization of some of these high-valuation names could potentially be a drag on an overextended portfolio for years or even decades to come.

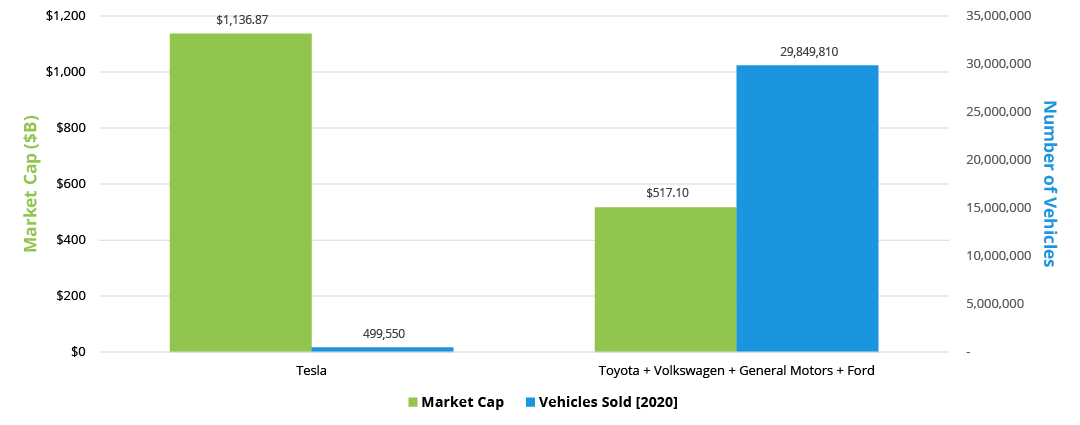

To illustrate this concept, we look at the electric vehicle manufacturers, an area of the market that has received a lot of attention from traders and investors recently. The developed economies of the world have clearly signaled that addressing climate change is a top priority, and efforts to slow the progression of climate change necessitate society moving away from fossil fuels and toward more clean, renewable energy sources, which naturally suggests a shift away from the internal combustion engine. A handful of states in the U.S. have already introduced zero-emission-vehicle mandates in some form (California, for example, set a deadline of January 1, 2035 for all new vehicles sold to be zero-emission). This environment has led to a run on the stocks of companies like Tesla (TSLA), Lucid Group (LCID), Rivian (RIVN), and others in anticipation of this revolution in personal transportation, which has pushed valuations in all three cases to astronomical heights. Tesla, which delivered approximately 500,000 units in 2020, is valued at over $1 trillion as of this writing. This compares to Toyota, which sold nearly 10 million units in the same period and is valued at only $300 billion. A number of other factors go into determining company valuation, including profitability and growth potential, but this extreme divergence is difficult to justify. Lucid Group and Rivian are much more nascent companies, and whether they will succeed at all remains to be seen. The two companies only began making production-ready vehicles this year and have delivered fewer than 1,000 vehicles combined. Nevertheless, the market has awarded the companies roughly $75 billion and $100 billion valuations, respectively, on hopes for the future. Even if you assume the success of these companies is a foregone conclusion, it could potentially be decades until the companies grow into their current valuations, and it may be a bumpy ride.

Figure 1 – Automobile Manufacturer Market Cap/Unit Sale Comparison

Source: Bloomberg

Why does this matter?

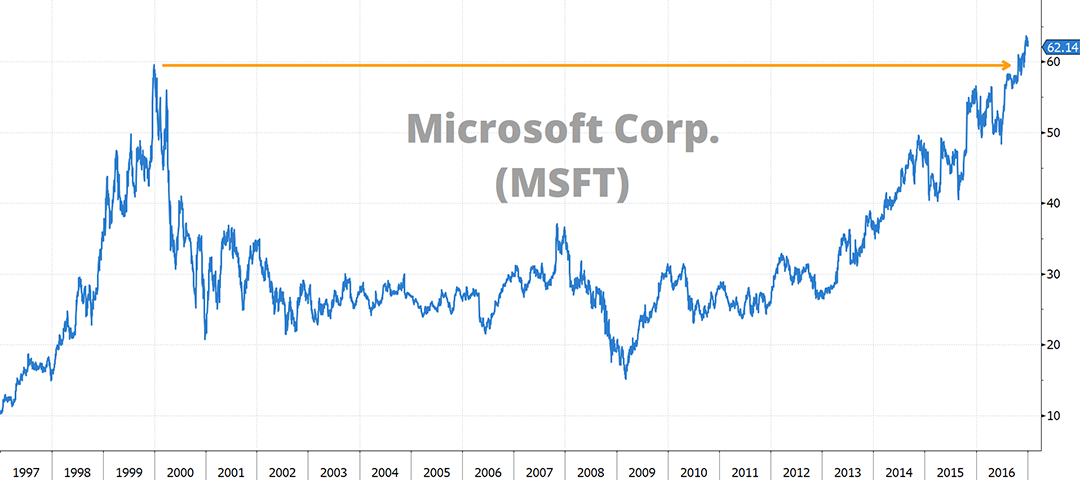

Remember, history may not repeat itself, but it often rhymes. We have seen this behavior before, most notably in the dot-com bubble of the late 1990s. During that period, companies were awarded lofty valuations in anticipation of how they would revolutionize society, and many of those companies eventually failed. We, however, want to focus on the ones that succeeded, and we need look no further than one of the largest and most successful companies of all time: Microsoft (MSFT). As the developer of the most ubiquitous business productivity software on the planet, Microsoft is a household name and currently worth almost $2.5 trillion. Additionally, the company is now a leader in cloud computing and other emerging technologies. Investors betting on the future success of the company have been proven correct; however, that does not necessarily mean that investments in the company have always been profitable. In fact, as the chart below illustrates, investors that bought shares of MSFT at the top of the tech bubble in early 2000 would not break even on their investment for nearly 17 years (assuming they actually held the stock for the duration of that period).

Figure 2 – Microsoft Corp. (MSFT) [1997-2016]

Source: Bloomberg

This was not an isolated incident. There are a number of examples of companies—Amazon (AMZN), Cisco Systems (CSCO), etc.—that went on to become incredibly successful in today’s world, but earlier investments in these companies may not have been profitable for some time, if at all. The electric vehicle manufacturers represent just one pocket of excess in today’s markets that we have seen emerge over the past couple of years, and we urge caution when considering an investment in these areas. It is entirely possible that one or more of these companies grows into a premiere EV manufacturer, selling millions of vehicles per year, but at today’s levels, you are likely paying for—rather than participating in—that future growth up front.

As the Fed removes support for the markets and becomes less accommodative over the next year and beyond, we expect that these pockets of excess will begin to fade and more attractive opportunities for long-term growth will arise.