The stock market is off to a rough start so far this year. As of Friday, 6/24/2022, the S&P 500 is down -17.93% and the NASDAQ Composite is down -25.81%. As the market grapples with the effects of inflation and the Federal Reserve’s intent to continue to raise rates to combat it, we are seeing outsized volatility and lower prices for the majority of stocks. No one likes it when markets are down, especially if they end the year with losses, but there is a potential hidden surprise waiting for many investors who own actively traded mutual funds in taxable accounts; it is the kind of surprise that can add insult to injury. It is very possible that, even in a down year, you could be facing capital gains taxes for mutual funds you own that are actually down for the year. Let me explain:

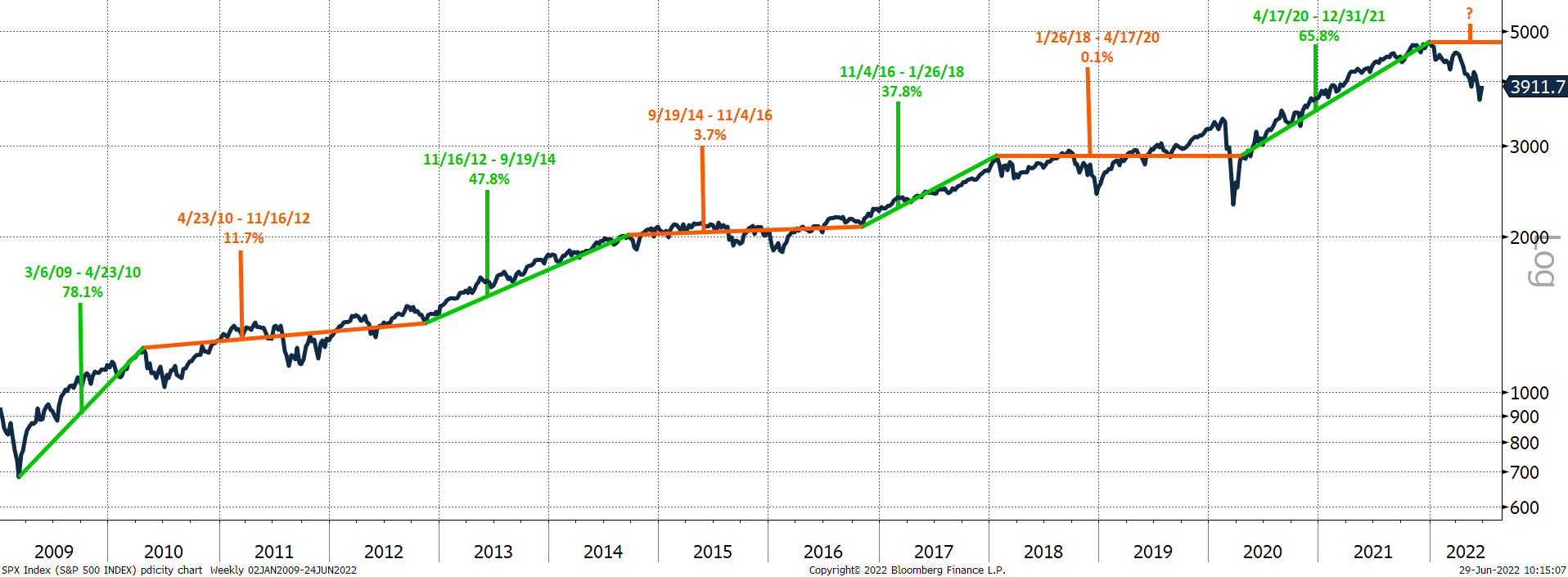

Everyone knows that the last decade (and more) was a good one for stocks. Our proprietary market cycle chart below shows that, while the stock market did not go up on a straight line, longer-term returns were quite impressive.

Figure 1 – Proprietary Market Cycle Chart (02 January 2009 – 24 June 2022)

Figure 1 – Proprietary Market Cycle Chart (02 January 2009 – 24 June 2022)Source: Bloomberg Finance

Mutual funds invested in stocks over this time period enjoyed generally good performance along with the overall market; however, mutual funds are significantly different from individual stocks in the way that taxable capital gains are realized by the investor. With individual stocks, capital gains are realized when an appreciated security is sold. It is a very simple process: (1) sell a winning stock, then (2) calculate your long- or short-term capital gains for that year. Mutual funds work the same way but with an additional twist. Of course, when you sell some or all of your mutual fund, you will pay a capital gains tax if the share price has appreciated. However, there is a second source of potential capital gains taxes that can be created by mutual funds; they are required to distribute any realized capital gains to all shareholders annually based on adjustments made internally to the portfolio during the year. In other words, it is possible to purchase a mutual fund, have the fund lose value during the year, and then be forced to pay a capital gains tax for that year even though your holding lost value.

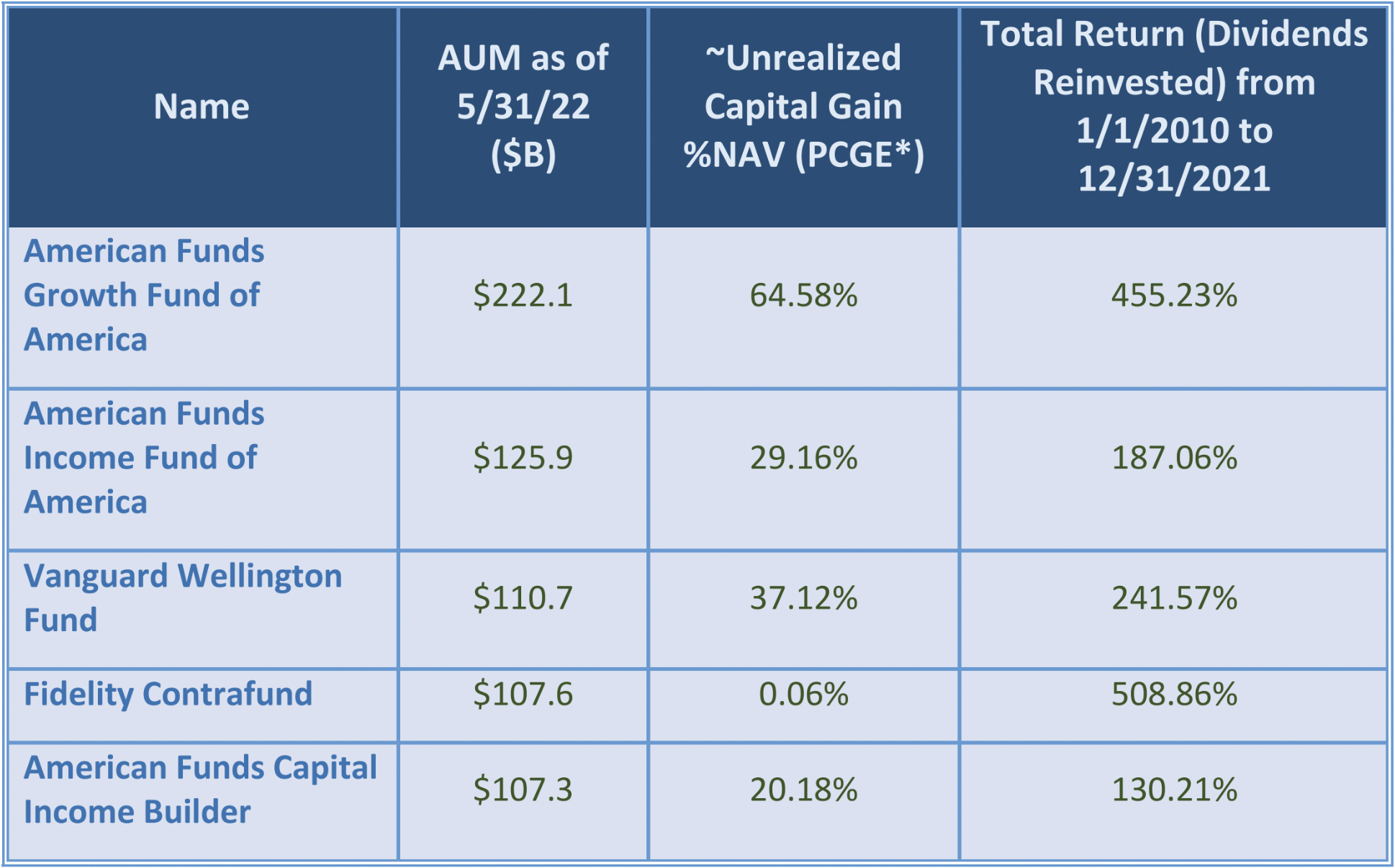

Let’s look at some of the largest non-index mutual funds to see how that unpleasant result could actually occur. I have listed some of the largest active mutual funds below*, which have all benefited greatly from the appreciating markets of the last 10+ years. However, when you look under the hood so to speak, you see differences in the amounts of unrealized capital gains.

Figure 2 – Select Largest Active Mutual Funds

Figure 2 – Select Largest Active Mutual FundsSource: Data provided by Morningstar*, Inc; Charles Schwab Mutual Funds Research

In the case of the Fidelity Contrafund, there are almost no unrealized capital gains. That fund has sold all or most of its appreciated securities over the years so there should be minimal capital gains distributions for this year, but that is not the case for the others. As an example, AGTHX [American Funds Growth Fund of America] has approximately 64% of the fund’s total NAV held as unrealized capital gains. Why is that a potential problem though? It comes down to how mutual funds work and how individual investors generally behave. When markets go down, like this year, people tend to start selling. The more markets go down, the more people tend to sell. When you see it in writing, it is counterintuitive. Of course, you should generally be buying more when things are cheaper, but we all know how investor psychology actually works in real life. When markets drop, people sell. When those sell orders come in, the mutual fund company will sell enough shares of stock to cover the liquidations, and this is where the time bomb can come in. If enough sell orders come in over time, the mutual fund can find itself in a position where it is forced to sell some of the highly appreciated securities to meet the demands of the sell orders coming in. This can create a situation where gains are being realized for all the holders of the mutual fund despite them not selling their shares. In the case of long-term holders of the fund, that is a bit easier to swallow since they benefited from the increase in values over the years. However, for new holders, they can find themselves in the undesirable position of seeing the values of their shares drop with the market, but also bearing the burden of realizing capital gains that were embedded in the fund when they bought it (even though they did not benefit from the years of growth that created those gains). This is not an ideal investment situation and can be a big surprise to investors who did not understand the actual mechanics of how their mutual fund works.

So what is an investor to do now? First, contact your mutual fund. Find out if there are any unrealized capital gains, and if so, how much. They may also be able to tell you the amount of capital gains realized so far this year, if any. Obtaining this information will at least give you more control over your tax situation in case the market has a down year. You could be in a position to take losses elsewhere or even in that particular fund if you intend to try to offset any capital gains distributed to you by your mutual fund. Also, it is a good idea to check on the unrealized capital gains a mutual fund is sitting on before you buy highly appreciated shares that you did not benefit from.

Controlling capital gains distributions is one of many reasons investors may choose investment vehicles other than active mutual funds. Remember, there is a distinction between active mutual funds like the ones listed above and index mutual funds. Most index mutual funds have minimal capital gains distribution issues because, by simply tracking an index, they make fewer stock trades. Exchange-traded funds, because they are generally considered to be “pass-through” investment vehicles, typically do not expose their shareholders to capital gains and can be even more tax friendly.

Another approach—the one we favor at Alpha Cubed Investments—is to generally own individual stocks and bonds when possible. Owning individual stocks allows an investor to more precisely budget for annual capital gains realizations, regardless of market conditions.

No matter what though, knowledge is power. If you own active mutual funds in your portfolio, it makes sense to find out what is going on under the hood so you can take control of your investment and tax planning. An informed investor is a better investor!

*Morningstar data on unrealized capital gains as a % of NAV (potential capital gain exposure/PCGE) is an estimate of the percent of a fund’s assets that represent gains. PCGE measures how much the fund’s assets have appreciated, and it can be an indicator of possible future capital gain distributions. Morningstar calculates potential capital gain exposure (PCGE) to give investors some idea of the potential tax consequences of their investment in a fund. PCGE measures the gains that have not yet been distributed to shareholders or taxed. It is especially relevant for investors who are considering a new purchase of a fund. If there are a lot of gains embedded in the fund, the investor may potentially receive capital gain distributions for gains that happened before they purchased the fund. (Source)

Disclaimer: Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark. The Standard & Poor’s 500 Index – S&P 500 is a market capitalization-weighted index of 500 large U.S. publicly traded companies by market value. The S&P 500 is one of the most common benchmarks for the broader U.S. equity markets. NASDAQ Composite is a market cap-weighted index of all equities listed on the NASDAQ stock market. Indices are unmanaged, do not incur fees and expenses, and cannot be invested in directly. Indices are unmanaged and do not reflect the payment of advisory fees and other expenses associated with an exchange-traded fund.