Being “on cycle,” to us, means adjusting to the current market environment, and we wanted to share one of many tools we use that helps us better understand the trends that are happening beneath the surface. Amid growing concerns about the decelerating growth of the economy, we are beginning to see a rotation reflected in asset allocation choices across the various sectors of the equity market.

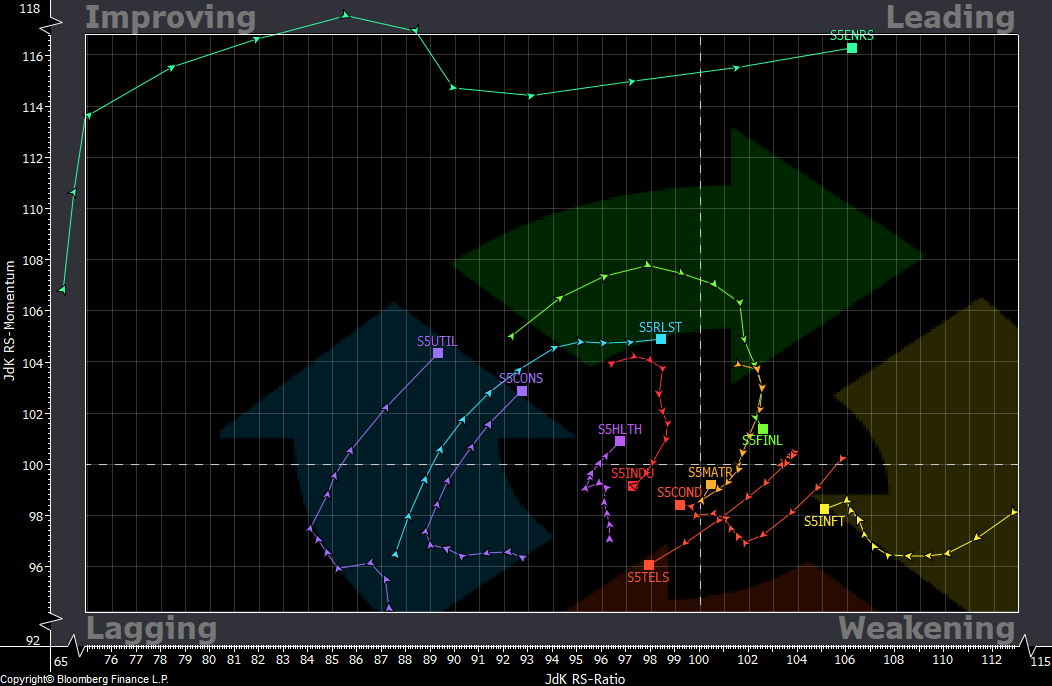

In the early stages of an expansion, the cyclical sectors—industrials, materials, and energy—typically come to the forefront. We saw this begin to take shape in the fourth quarter of 2021, but it took over in earnest in the first quarter of this year with many stocks in those sectors outperforming the broader market. The amount of time the market spends in each phase of these cycles varies, and we would normally expect this broadening of cyclical exposure to happen more gradually over a period of years. Under normal conditions, the Fed is able to incrementally raise interest rates as the economy recovers to rein in monetary conditions; however, higher-than-average inflation is, in this case, forcing the Fed’s hand, which could shorten this current expansionary phase. In fact, the market may already be shifting toward a more defensive posture that could last the remainder of the year, and we can clearly see this evolution in the sector rotation chart below. This chart depicts a live look at each of the sectors within the S&P 500 and their strength and momentum relative to the index as a whole.

Figure 1 – Relative Rotation Graph (12-Period Monthly)

Source: Bloomberg (4/19/22)

Each line represents a different sector, and each of the 12 points on those lines represents one month. As you can see, the sectors that are typically viewed as being more defensive—utilities (S5UTIL, purple), consumer staples (S5CONS, purple), health care (S5HLTH, purple), and real estate (S5RLST, light blue)—are all moving into the “improving” quadrant. Meanwhile, industrials (S5INDU, red), materials (S5MATR, light orange), information technology (S5INFT, yellow), communication services (S5TELS, dark orange), and consumer discretionary (S5COND, dark orange) are all considered to be weakening or lagging right now. Volatility in a mid-cycle recovery may cause some people to want to get out of the market entirely, but often the key to long-term success is rotation within the market rather than cashing out.