YoY CPI for July 2022 came out last week at 8.5%, which is cooler than the expected 8.7% print and a deceleration from last month’s 9.1% reading. This has fueled strength in both equities and bonds as expectations are rising that the Fed may be become a bit less hawkish in the months ahead.

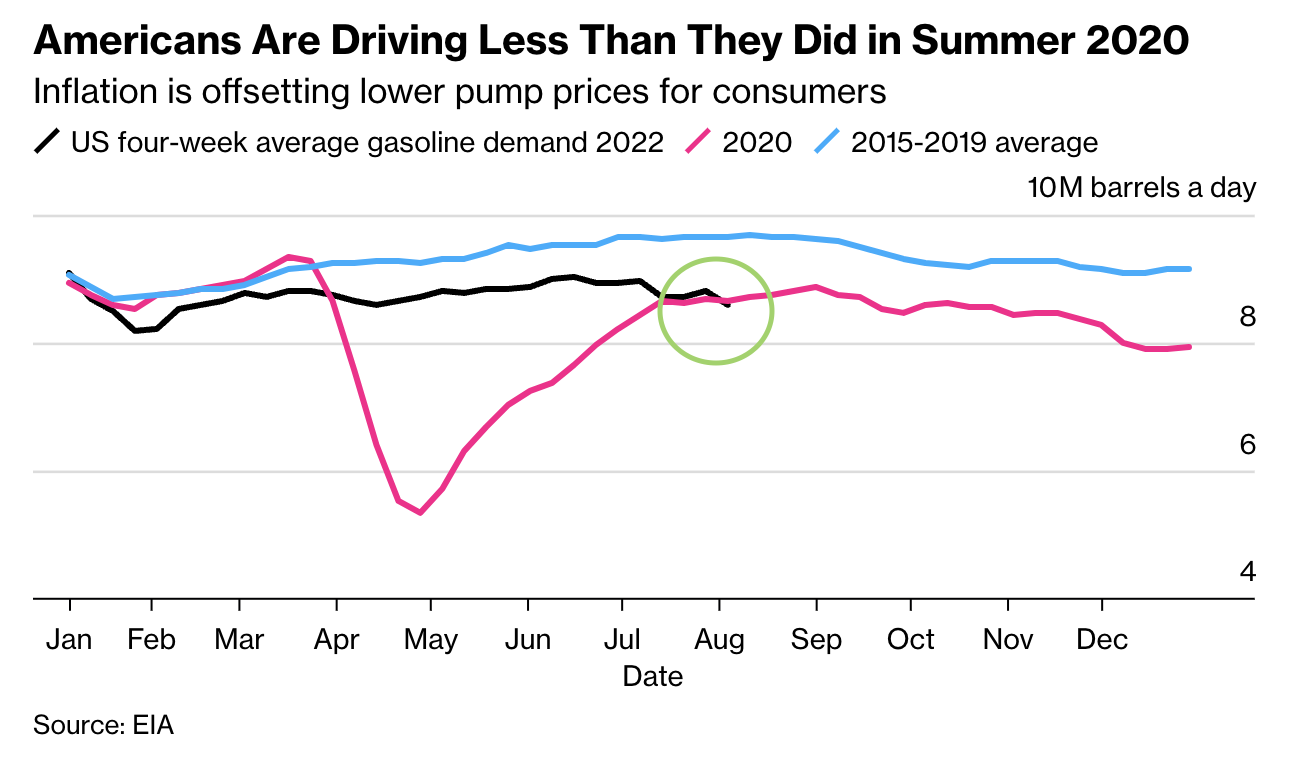

This lower-than-expected print was driven by a drop almost across the board in energy prices and led to a slight decline in the overall CPI index. One of the best cures for high energy prices is high energy prices—the higher they go, the more the higher prices weigh on demand. Throw in some Fed tightening, and you have a recipe for demand destruction, which is the goal. Gasoline demand over the past 4 weeks was actually lower than during the summer of 2020 when we were all on lockdown in our homes (chart below).

Figure 1 – Americans Are Driving Less Than They Did in Summer 2020

Figure 1 – Americans Are Driving Less Than They Did in Summer 2020Source: EIA, Bloomberg (https://www.bloomberg.com/news/articles/2022-08-03/summer-gasoline-demand-in-us-plunges-below-pandemic-levels)

This drop in energy prices was largely offset by continued inflation in food and shelter costs. Shelter costs rose 0.5% from June; this may not seem like a large jump, but this is the biggest line item in the index and makes up about a third of the overall number because it occupies a significant portion of consumers’ wallet share. The Fed has stated that they want to see multiple months of material improvements, and this continued increase in shelter will surely play into their thinking going forward.

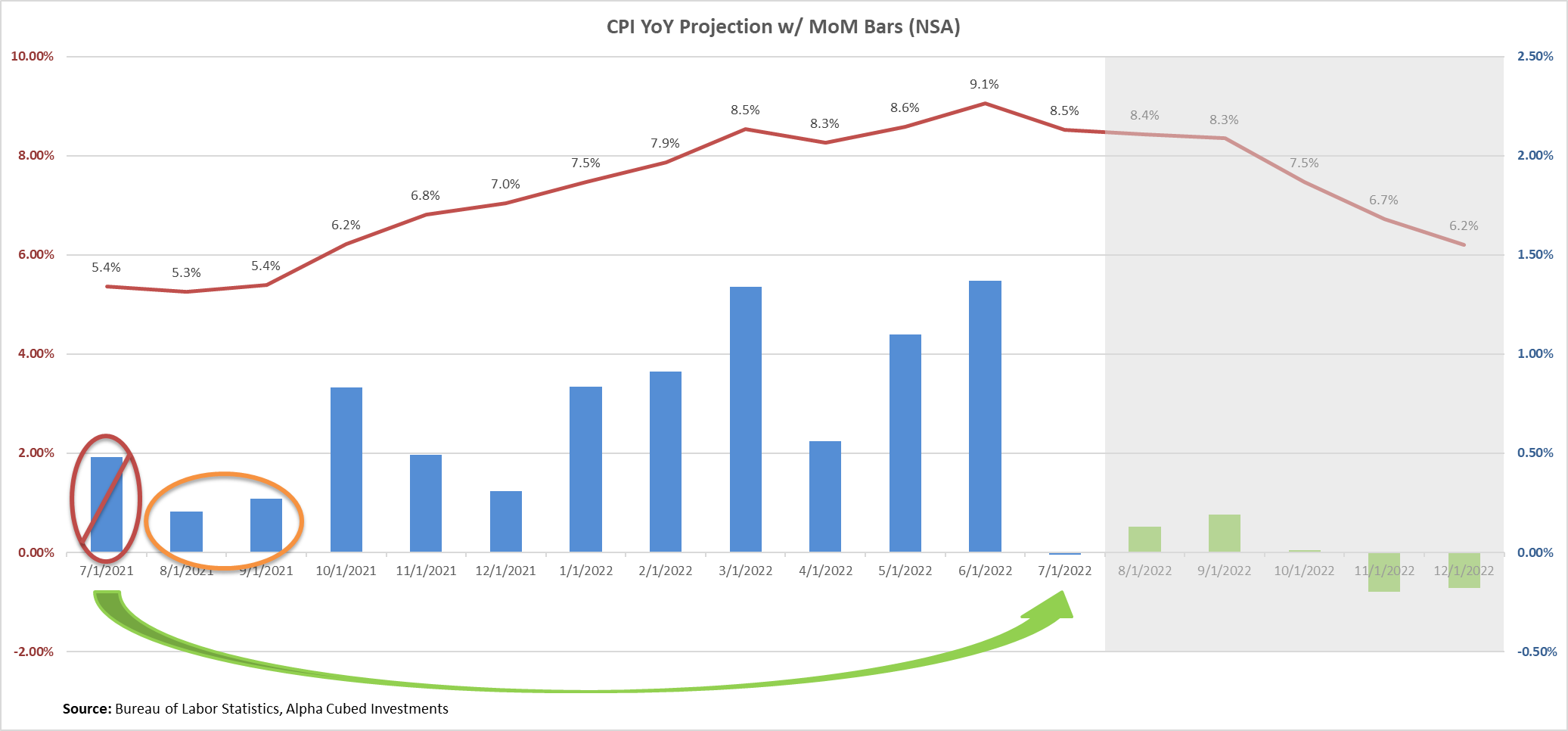

I have included an updated CPI projection below. Last week’s lower-than-expected print gives us a path to a sustained deceleration in headline YoY CPI, but we are not out of the woods yet. July 2022’s -0.01% NSA MoM print replaced July 2021’s 0.48% NSA MoM print; however, August and September 2021 will be even more difficult comparisons to beat. The values used for the green MoM projection bars below are 20-year averages of each month’s historical figures. If we can meet or beat those projections (on the downside) going forward, we conceivably have a path to 6% or lower YoY CPI by year end. That may be a tall order given the environment, but the possibility is there. The median estimate for year-end 2022 according to Bloomberg consensus is still 8.0%, so we will see if those projections begin to drop over the coming days in light of this recent print. Inflation is one of the key drivers of this market, and we will continue to provide updates on the situation as it evolves.

Figure 2 – CPI YoY Projection w/ MoM Bars (NSA)

Figure 2 – CPI YoY Projection w/ MoM Bars (NSA)Source: Bureau of Labor Statistics, Alpha Cubed Investments