The Federal Open Market Committee (FOMC) came out with its latest policy decision yesterday, and as the market expected, the committee hiked its benchmark rate by another 75 basis points, making this the fourth consecutive hike of that magnitude.

More interestingly, though, this announcement was widely anticipated to be a potential pivot point to a slower pace of monetary tightening going forward. The question was how the Fed would achieve such a pivot without easing monetary conditions in the process, undoing the work they have done. This is tricky because the market is a forward-discounting mechanism, quick to price in expectations for the future, and if investors sense a hint of dovishness, they are likely to rush back into risk assets, pushing asset prices higher and longer-term interest rates lower. This is precisely what we saw, as the Fed made a significant change to its prepared statement today, adding the line below:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

General consensus is that rate hikes typically take around 9-12 months to begin to be incorporated into the economic landscape, so we have not yet seen the full effect of the hikes that have already been implemented this year—and the Fed knows this. The market has been searching for a glimmer of light at the end of the tunnel, and it latched onto this language immediately as a dovish tilt.

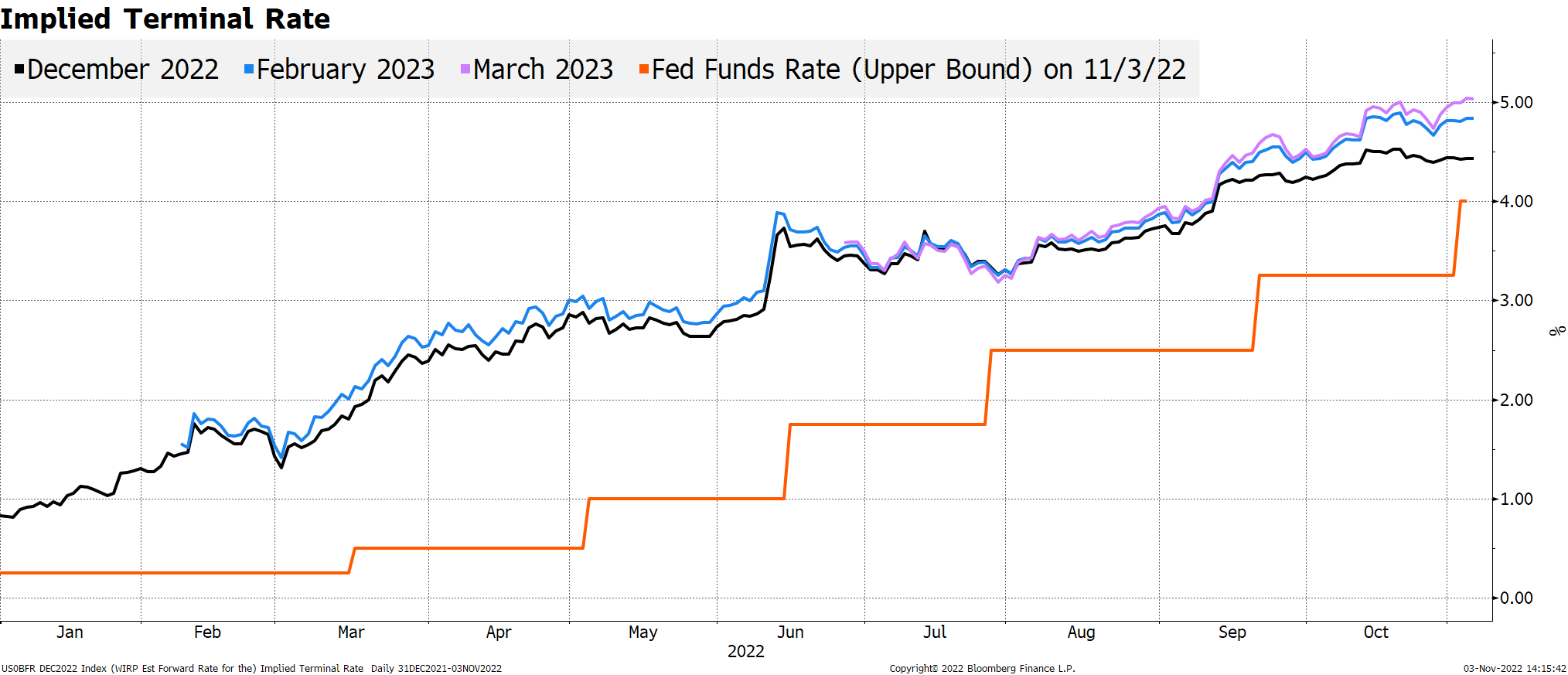

However, during the press conference following the announcement, Federal Reserve Chair Jerome Powell balanced that statement, acknowledging that rate hikes would likely be slower going forward but also saying that the terminal level of interest rates would now be higher based on the strength of recent economic data. This caused stocks to reverse course and head lower. It is clear that the Fed sees importance in depressing asset values to help bring inflation down to its long-run target, and this is the type of tightrope act that we expect from the Fed over the medium term. The Fed cannot signal the “all clear” until there are material and significant declines in inflation; otherwise, asset values rise and interest rates fall, refueling inflationary pressures.

Figure 1 – Implied Terminal Rate

Figure 1 – Implied Terminal RateSource: Bloomberg

The Fed does plan to continue tightening and will do so until policy is “sufficiently restrictive.” We believe that this is going to keep equity valuations within a range for a period of time, but it does begin to pave the Fed’s offramp from this round of policy tightening. This tug of war is the type of action we expect to characterize the market for the foreseeable future—positive movements that are then tempered by negative developments—keeping the market in a sideways or “sawtooth” pattern as the excesses from the pandemic work their way through the economy.

The CPI report for October will be released on November 10th, and investors will be watching it closely for signs that could influence the Fed’s gameplan going forward.